Gender and Financial Literacy Initiatives

8 films on Financial Literacy and Women Empowerment |

|

|

|

|

Financial Inclusion and women empowerment Initiatives-Output IV |

|

|

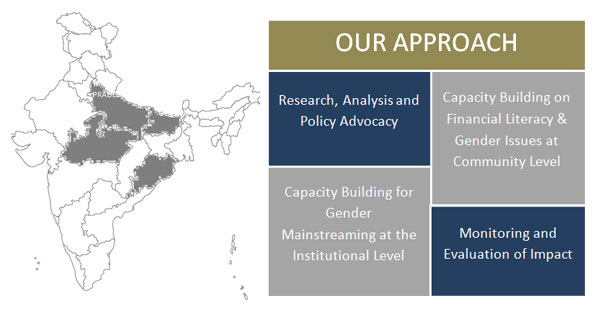

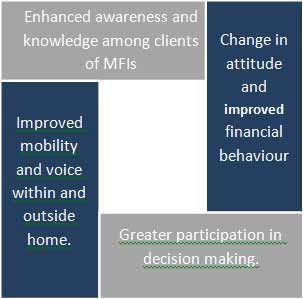

The PSIG states are amongst the lowest in terms of Gender Development Index (GDI) including economic marginalization, mobility restrictions due to cultural norms, poor health conditions, and various forms of discrimination and violence against women. Therefore, PSIG endeavours to focus specifically on women’s empowerment through microfinance interventions including financial literacy programme and capacity building of women clients on social, gender and legal rights and entitlements issues. In pursuing this goal outlines three levels of work:

|

|

|

|

Our major initiatives |

|

|

|

| The PSIG states are amongst the lowest in terms of Gender Development Index (GDI). | |

Methodology of Training |

|

| The FL&WE projects adopt the Training of Trainer (ToT) approach to develop a cadre of community resource persons (called Mater Trainers), trained by experts, to train women clients of microfinance institutions (MFIs) in turn. The trainings are a combination of assisted learning, learning by doing using games and exercises and usage of audio visuals. | |

| Key Areas of Training | |

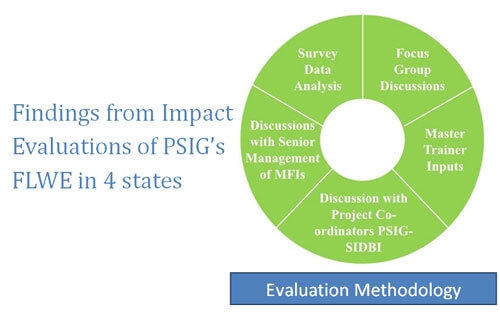

The training of trainers (ToT) was conducted in 3 phases over a period of 12 months. The training of women was conducted in three phases of three days each. Training duration was for three hours a day. A mobile based MIS was adopted for collection of real time data for monitoring and evaluation purposes. |

|

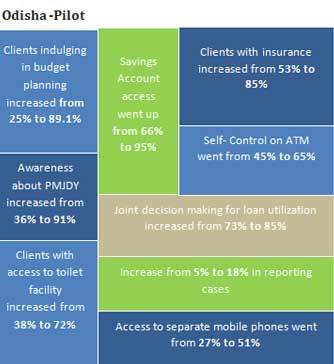

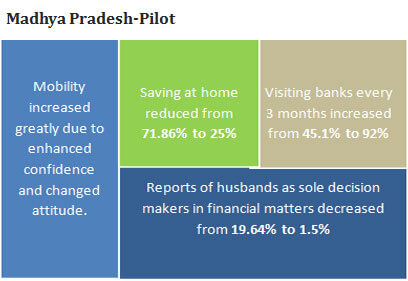

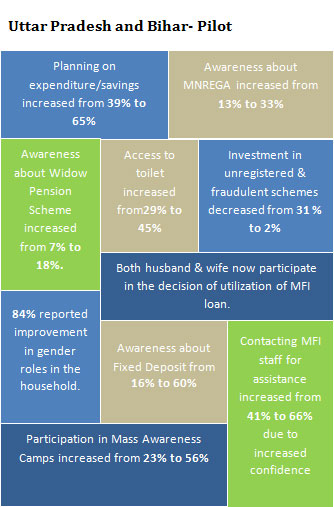

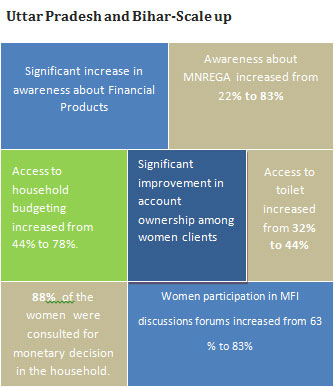

How we made a difference |

|

|

|

|

|

|

|

|

|

|

|

|

The major initiatives undertaken by PSIG towards realizing these goals are given below:

Copyright © 2025 Small Industries Development Bank of India (SIDBI). All rights reserved

Last Updated: 09-12-2025