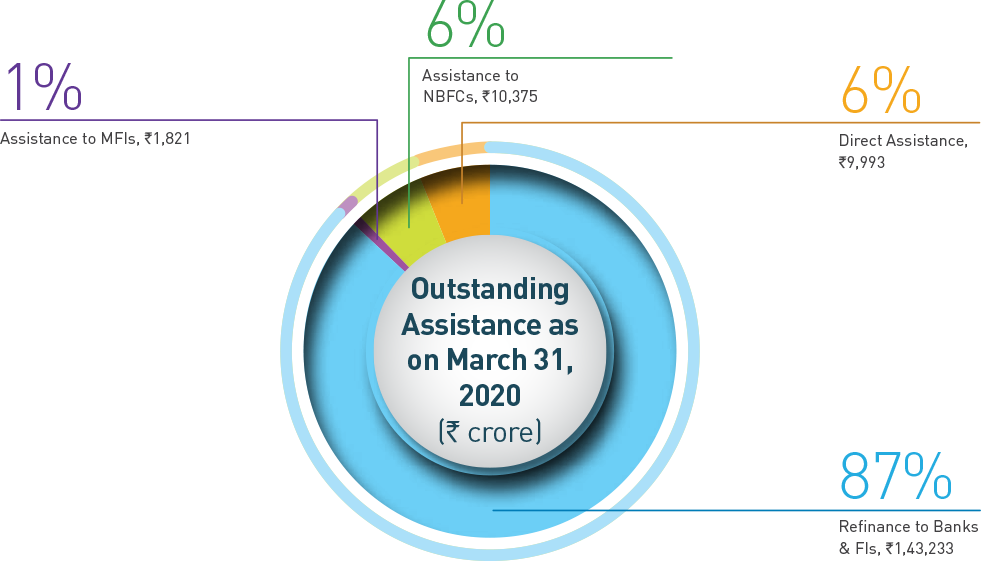

The Bank’s Institutional Finance asset book crossed the landmark figure of ₹1.5 lakh crore and stood at ₹1,55,429 crore as on March 31, 2020, recording a growth of 22.6%.

Provided refinance to 44 Banks and 30 NBFCs operating in the market

60 MFIs are live clients as of March 2020

Institutional finance outstanding accounts for 13.5% of the total MSE outstanding in the country as of March 2020

Cumulative sanctions and disbursements to MFIs as on March 2020 aggregated to ₹19,871 crore and ₹17,951 crore respectively

Assistance to MFIs has cumulatively benefited approximately 390 lakh disadvantaged people, mostly women, transforming their lives leading to economic development and social empowerment

During FY 2020, several new initiatives were undertaken to deepen the outreach viz (i) initiating new partnerships (ii) launching new simplified products with reduced TAT (iii) simplifying processes (iv) digitising products / processes (v) enhancing customer engagement (vi) a timely response to macro-factors.

• LIQUID scheme to provide assistance up to ₹1.5 crore in the form of WCTL

• SAFE to provide Capex and WC support to MSMEs at 5% with target TAT of 48 hours

• SAFE Plus Scheme for immediate WC assistance for undertaking orders from Government or Government agencies

• Special facility for Capex financing needs of the healthcare sector under SMILE

• Emergency Ad-hoc Limit under WC Scheme and Emergency TL under DCS